We at Aptitude Software are thrilled to release a new product, the Aptitude Revenue Recognition Engine. The product is designed to help telecommunications operators and other companies faced with implementing new international accounting requirements.

Following up on our earlier announcement, Aptitude Software today released the Aptitude Revenue Recognition Engine. The new product helps enterprises to face new IASB and FASB accounting rules for ‘Revenue Recognition from Contracts with Customers’ (IFRS 15, FASB Topic 606).

The Challenge Posed by New Accounting Requirements

The new accounting standards affect how companies in many industries will recognize revenue. These changes require completion of operational process, accounting and systems changes by 1 January 2017, although many organizations will process the comparative financials from 2016, a very challenging implementation timetable.

IFRS 15 impacts companies in many industries, particularly those such as telecommunications operators and high-tech product manufacturers that use contracts with long-term service obligations and product bundling.

Some companies argued against the new IFRS 15 requirement, in part due to the cost and complexity of implementing new, or adapting existing, IT systems needed to account for millions of transactions and complex multi-part contracts.

Aptitude Software’s Revenue Recognition Engine (RRE)

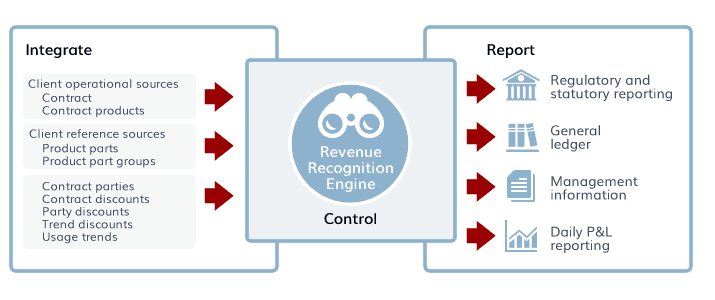

Aptitude Software’s new RRE product is a high performance, pre-built calculation engine, enabling operators to quickly and efficiently address the accounting requirements while minimizing the impact on existing systems and business models.

It fits seamlessly within an organization’s existing environment, reducing the impact on billing systems, and provides template calculations for many common recognition scenarios, outputting current, proposed, and ‘delta’ revenue figures. Its accrual accounting can also be extended to provide custom processing for accruals and deferrals arising from billing cycle cut-offs.

Aptitude Software’s Revenue Recognition Engine is believed to be the first demonstrable product on the market and has been reviewed by leading auditors as well as major US and European telecom operators.

It enables companies to integrate detailed contract and billing data; apply revenue apportionment rules; derive balance sheet accruals/deferrals; and manage important lifecycle events such as contract modifications and bad debt provisions.

Commentary

“Aptitude Software has been working with a number of leading organizations, including some of the biggest telecommunications operators and firms in a range of other industries, to develop the Aptitude Revenue Recognition Engine” says Tom Crawford, President of Aptitude Software. “Given the very short time scales, we believe our first-to-market packaged solution, built on the high performance Aptitude platform, will mitigate the depth of change, risks and costs for those affected by IFRS 15.”

More information on the Aptitude Revenue Recognition Engine can be found on our website.