With many finance teams wrapping up revenue recognition projects, lease accounting (IFRS 16 / ASC 842) projects have taken a backseat. Unfortunately, for public companies, the deadline for this standard – January 2019 – is fast approaching.

So how can companies quickly check the lease accounting compliance box in time? Many are looking to pre-packaged software solutions to help centralize required lease data, automate the accounting and empower finance to manage leases and their overall leasing strategy going forward.

As regulatory change experts, we have helped many organizations through compliance initiatives like revenue recognition, IFRS 17 and of course, lease accounting. We have the technology, accounting capabilities, implementation processes and partner relationships to accelerate the delivery of an accounting change project. Together, we can do this!

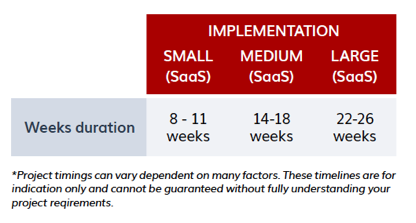

The timeframes in the chart below provide a simple duration estimate for a small, medium and large lease accounting implementation. With the deadline a mere 4 months away, there is no time to waste.

Of course, due to the nature of the IFRS 16 and ASC 842 rules, the scope of a project depends heavily on the complexity and scale of your lease portfolio and systems architecture. To gather requirements and determine the tier size for each project we look at a number of factors such as:

- Total number of leases

- Number of legal entities

- Countries that are operated in

- Lease classes

- Lease types (lessee/lessor/subleases/embedded leases)

- Number of chart of accounts